Top 100+ AI Companies

- The market size in the Artificial intelligence (AI) market is projected to reach US$305.90bn in 2024.

- The market size is expected to show an annual growth rate (CAGR 2024-2030) of 15.83%, resulting in a market volume of US$738.80bn by 2030.

- In global comparison, the largest market size will be in the United States (US$106.50bn in 2024) (Source: Statista)

By 2027, spending on AI software will grow to $297.9 billion, with a CAGR of 19.1%. Over the next five years, the market growth will accelerate from 17.8% to reach 20.4% in 2027. Generative AI software spend will rise from 8% of AI software in 2023 to 35% by 2027, according to Gartner.

Today’s leading Top AI companies in the world are expanding their technological reach through other technology categories and operations, ranging from predictive analytics to business intelligence to data warehouse tools to deep learning, alleviating several industrial and personal pain points. There are several areas where artificial intelligence trends will have a tremendous impact in the year 2024.

“The AI software market is picking up speed, but its long-term trajectory will depend on enterprises advancing their AI maturity,” said Alys Woodward, senior research director at Gartner.

The AI software market encompasses applications with AI embedded in them, such as computer vision software, as well as software that is used to build AI systems. Gartner’s AI software forecast is based on use cases, measuring the amount of potential business value, timing of business value and risk to project how use cases will grow.

Gartner forecasts that the top five use case categories for AI software spending in 2022 will be knowledge management, virtual assistants, autonomous vehicles, digital workplace and crowdsourced data (see Table 1).

Table 1. AI Software Market Forecast by Use Case, 2021-2022, Worldwide (Millions of U.S. Dollars)

| Segment | 2021 Revenue | 2021 Growth (%) | 2022 Revenue | 2022 Growth (%) |

| Knowledge Management | 5,466 | 17.6 | 7,189 | 31.5 |

| Virtual Assistants | 6,210 | 12.0 | 7,123 | 14.7 |

| Autonomous Vehicles | 5,703 | 13.7 | 6,849 | 20.1 |

| Digital Workplace | 3,593 | 13.7 | 4,309 | 20.0 |

| Crowdsourced Data | 3,483 | 13.6 | 4,171 | 19.8 |

| Others | 27,049 | 14.1 | 32,827 | 21.4 |

| Total | 51,503 | 14.1 | 62,468 | 21.3 |

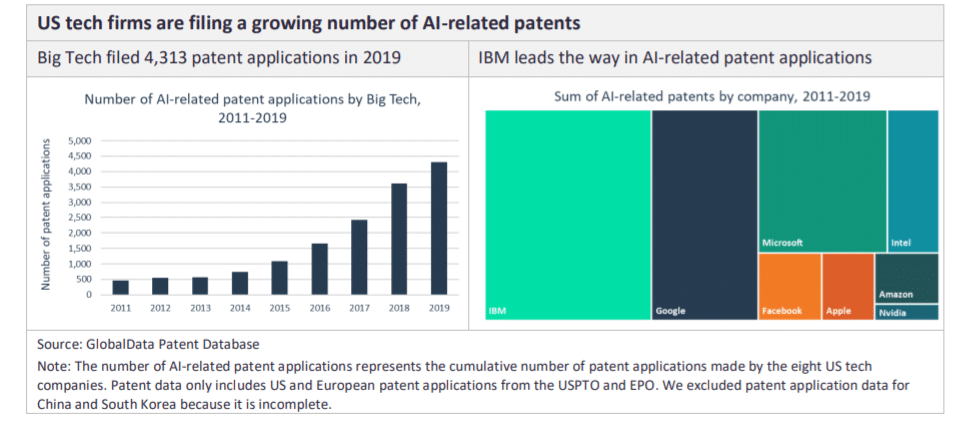

A large share of IBM’s patent applications in 2019 focused on natural language processing (NLP). Speech recognition, machine learning, and neural networks have been particularly prominent among Big Tech’s patent applications recently.

The leaders in AI technology

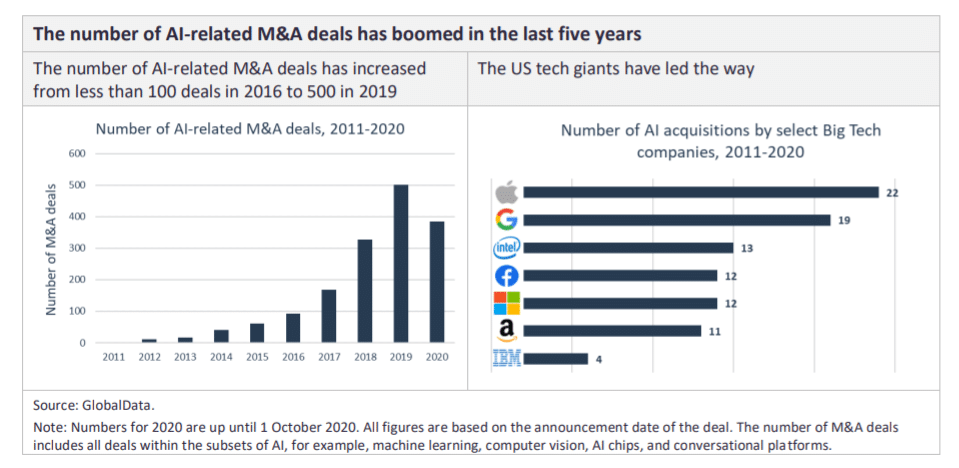

The number of AI-related Merger & Acquisitions deals has increased from less than 100 deals in 2016 to 500 in 2019, with Apple leading the US tech giants, followed by the rest of GAFAM alongside Intel and IBM. Top AI companies and big data analytics companies are focusing on developing AI products to increase market.

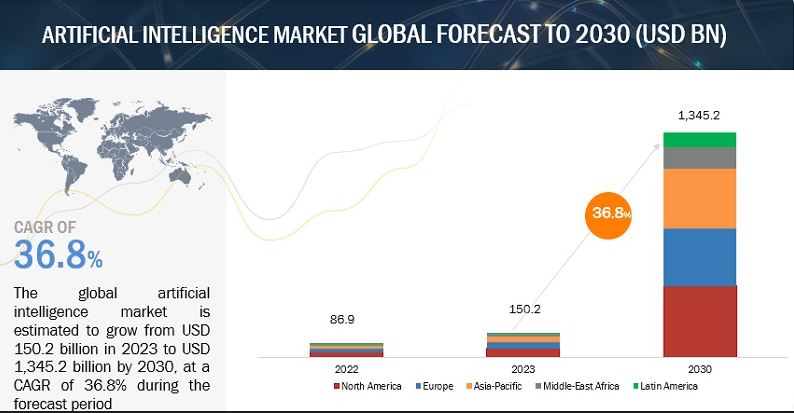

The global AI platform market has been segmented on the basis of regions into North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. North America is estimated to be the largest revenue-generating region. This is mainly because, in the developed economies of the US and Canada, there is a high focus on innovations obtained from R&D.

It’s clear that companies with access to large amounts of data to power AI models are leading AI development. Key groups within AI include GAFAM (Google, Apple, Facebook, Amazon and Microsoft), BAT (Baidu, Alibaba, and Tencent), early-mover IBM and hardware giants Intel and Nvidia. The top artificial intelligence companies and ai data analytics companies are investing in AI and machine learning.

Worldwide revenues for the artificial intelligence (AI) market, including software, hardware, and services, is forecast to grow 19.6% year over year in 2022 to $432.8 billion, according to the latest release of IDC Worldwide Semiannual Artificial Intelligence Tracker. The market is expected to break the $500 billion mark in 2023.

Among the three technology categories, AI Software will see its share of spending decline slightly in 2022 as spending for AI Hardware and Services grows more quickly. This trend will continue into 2023. Overall, AI Services is forecast to deliver the fastest spending growth over the next five years with a compound annual growth rate (CAGR) of 22% while the CAGR for AI Hardware will be 20.5%.

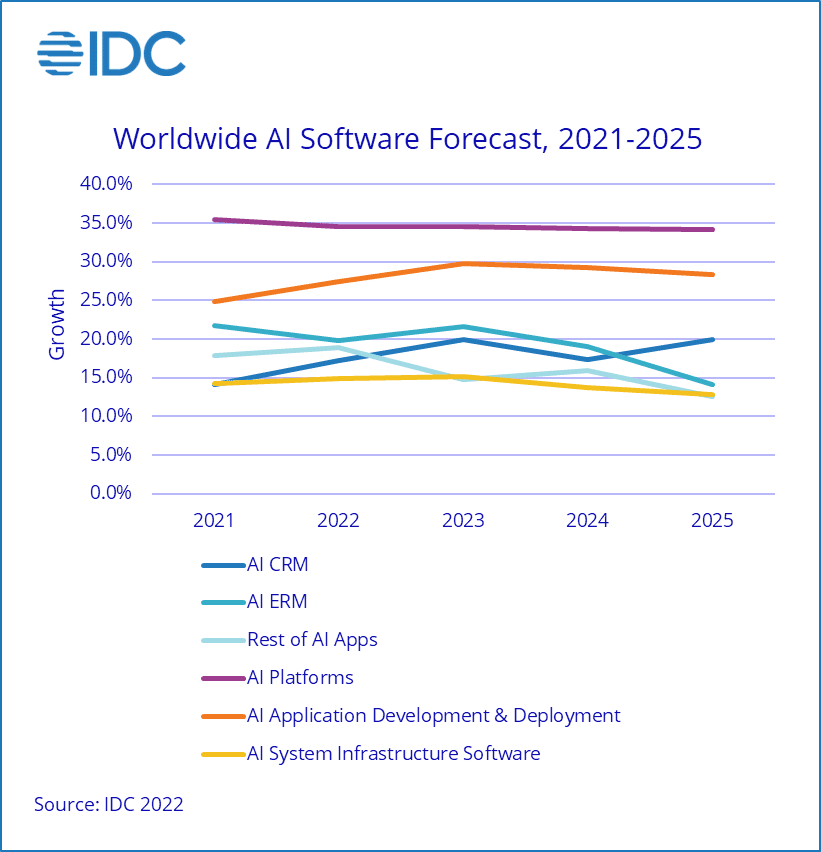

In the AI Software category, AI Applications accounted for 47% of spending in the first half of 2021, followed by AI System Infrastructure Software with around 35% share. In terms of growth, AI Platforms are expected to perform the best with a five-year CAGR of 34.6%. The slowest growing segment will be AI System Infrastructure Software with a five-year CAGR of 14.1%.

Within the AI Applications segment AI ERM is forecast to grow the fastest over the next several years relative to AI CRM and the rest of AI Applications. Among all the named software markets published in the Tracker, AI Lifecycle Software is forecast to see the fastest growth with a five-year CAGR of 38.9%.

Also see: Top datasets to actualize machine learning and data training tutorial How AI and Machine Learning Will Affect Machining What Is Machine Learning and Where to Find the Best Courses? Guide To Unsupervised Machine Learning: Use Cases What Are Transformer Models In Machine Learning Difference between Machine learning and Artificial Intelligence Machine Learning Models in Production

Top 100 AI companies in the world:

To keep up with the AI market, Here is the list of top 100 AI companies in the world, These top Artificial Intelligence companies, ai data analytics companies and big data companies playing a key role in shaping the future of AI.

- Apple

- Amazon Web Services

- Microsoft

- HPE

- Ayasdi

- Qualcomm Technologies

- Absolutdata

- Alibaba Cloud

- Salesforce

- IBM

- Intel

- Tencent

- Cambricon

- Darktrace

- Megvii

- Mobvoi

- SenseTime

- OpenAI

- Vicarious

- Ubiquity6

- AIBrain

- CloudMinds

- Affectiva

- Nvidia

- AI.Reverie [Enterprise technology]

- Siemens

- DefinedCrowd

- MightyAI

- Dataiku

- Machinify

- DataRobot

- Tamr

- H20.ai

- Trifacta

- Dremio

- SigOpt

- Mabl

- Applitools

- Demisto

- Anodot

- Shape Security

- Vectra Networks

- Area 1 Security

- Agari Data

- Jask Labs

- Perimeter X

- BounceX

- Unbabel

- Gong

- Gamalon

- FullStory

- UiPath

- Automation Anywhere

- Orbital Insight

- Descartes Labs

- Element AI

- SparkCognition

- Prowler.io

- Bossa Nova Robotics

- SenSat

- 4Paradigm [Finance and insurance]

- BioCatch

- DataVisor

- HyperScience

- Behavox

- AppZen [Government]

- One Concern

- SenseTime

- Face++

- Yitu Technology

- Fortem Technologies

- Shield AI

- Benson Hill Biosystems [Agriculture]

- Taranis

- Auto

- Nuro

- Pony.ai

- Drive.ai

- Nexar

- DeepMap

- Mapillary

- Momenta

- AEye

- DeepScale

- Iris Automation

- Perceptive Automata

- Qventus [Health care]

- LeanTaaS

- Insitro

- Owkin

- Atomwise

- Paige.ai

- Niramai

- Butterfly Network

- IDx Technologies

- Arterys

- Viz.ai

- Mindstrong Health

- Gauss Surgical

- Medopad

- Sense Labs [Industrial]

- Falkonry

- C3

- Kebotix

- Zymergen

- Landing AI

- LawGeex [Legal, compliance, and HR]

- Eigen Technologies

- Onfido

- Textio

- AI Foundation [Media]

- New Knowledge

- Arraiy

- Hover [Real estate]

- Skyline AI

- TwentyBN [Retail]

- Abeja

- Signifyd

- AiFi

- Sift

- Habana Labs [Semiconductor]

- Graphcore

- Cerebras Systems

- Horizon Robotics

- Thinci

- Syntiant

- Mythic

- Mist Systems

Also see:

Top Artificial Intelligence Statistics: Trends, Facts for 2024

Top 20 Artificial Intelligence Platforms for 2024

200+ Free Datasets for Data Science, Machine learning, AI, NLP

Difference between Machine learning and Artificial Intelligence

Artificial Intelligence: Automating Hiring Process For Businesses!