Tools, Skills, and Knowledge of a Fund Manager

The Forbes list of the wealthiest people in the world traditionally includes hedge fund managers. The biggest gainer of the group is also the youngest hedge fund manager on The Forbes 400. Chase Coleman, the 45-year-old founder of New York-based Tiger Global Management, is worth $6.9 billion, Forbes calculates.

Not surprisingly, the role of a successful fund manager is a cherished dream for many novice traders and investors. Let’s try to put together the central portrait of a successful hedge fund manager – what skills does he have, and what special tools does he use?

What is a hedge fund manager?

The person who organizes the hedge fund and oversees its investment process is the fund manager — often called the portfolio manager or even PM for short. The fund manager may make all the investment decisions, handling all the trades and research himself, or he may opt to oversee a staff of people who give him advice.

Many hedge funds are small organizations (fewer than 500 employees). In some cases, the fund managers work alone. These funds have a small number of investors, and they may not allow their investors to take money out for a year or two, so they don’t need to do constant marketing. It rarely makes sense for a hedge fund to have a dedicated marketing person on staff.

What makes a good hedge fund manager?

What separates hedge fund managers from other types of fund management is that they are usually directly related to the fund itself. A hedge fund manager usually specializes in a particular investment strategy that he uses as a mandate. His management company is owned by a portfolio manager, which means he is entitled to a larger share of the hedge fund’s return.

The hedge fund is funded through management fees that cover operating expenses and performance fees, which are usually paid to owners as profit.

If you want to invest in a hedge fund, you must meet income and asset requirements. Hedge funds are considered risky because they pursue aggressive investment strategies and are often regarded as risky because of the aggressive nature of their investments and the risk they are exposed to.

What skills does a hedge fund manager need?

They must have specialized and comprehensive knowledge of the sectors in which they will manage investments, be it stocks or other securities. Then they need an investment strategy that outperforms other funds. In such a case, formal qualifications such as graduate degrees in financial services are not an absolute requirement, although it helps.

A hedge fund manager will be able to analyze various data and market trends and see patterns and trends to develop a strategy quickly. Social skills are also necessary, as leveraging relationships and contacts is key to making the most business opportunities and working with investors. Finally, hedge fund managers need a keen competitive desire to do better than other funds.

Popular hedge fund management tools

Each hedge fund uses a different set of market instruments. Of course, we can list the popular tools and services used in each specific area of the hedge fund’s activities because they are far from only buying and selling assets. For example, solving personnel issues may require access to paid specialized services or payment for the services of a reliable HR agency. Or, say, marketing also takes up some part of the work of hedge fund managers. The ability to convince people to leave their money with you to invest is a basic requirement for any aspiring manager. Here comes the need to use marketing tools, ranging from targeted advertising on LinkedIn to operations, investor relationship management in CRM systems like Clienteer.

Using a firm’s back-office system for deal resolution, accounting, and risk management is an integral part of a hedge fund’s job. Many people use such systems to check their accounting from Excel. A custom-configured back-office system can be used to generate daily risk management reports, which is also highly desirable.

Hedge fund traders are pretty active in using Bloomberg and various trading platforms. Bloomberg falls into the “must-have” category for most traders, although there are alternatives like Thomson Reuters. Trading platforms, of course, depend on the type of trading you have.

It is worth mentioning separately the turnkey solutions for hedge fund managers, becoming more and more popular in the market. The largest provider of OTC trading software, MetaQuotes Software Corp., has a version of its trading platform MetaTrader 5 designed specifically for hedge funds.

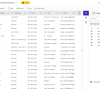

In MetaTrader 5 Administrator, you can create a fund, set up payments and commissions, add fund managers, and open trading accounts for investors.

As for trading itself, Python programs have native integration with the MetaTrader 5 terminal, which allows the trading department to receive market / historical information, manage positions, and trade.

With convenient tools in hand for conducting transactions and making transactions, it is (theoretically) possible to create a hedge fund of one person. Of course, you should consider that you still have to delegate some tasks to a third-party company: accounting, regulatory, and custodian functions. You are unlikely to be able to enter Forbes as a single-person hedge fund manager, but you always have to start somewhere, right?