How Using Data and Analytics Helped Create Useful Bankruptcy Calculators

Using big data and analytics is essential to building products that work and that customers enjoy using.

Bankruptcy calculators are a great way to provide unbiased information to individuals looking to understand their debt relief options. Bankruptcy requires empathy. Even Dave Ramsey, the finance guru, filed bankruptcy. So, bankruptcy calculators use data and analytics to help people understand their options. With that being said, it is important to continuously update and tweak the experience in order to create the most useful bankruptcy calculator.

What is a Bankruptcy Calculator?

A bankruptcy calculator helps you estimate Chapter 7 qualification or a Chapter 13 plan payment example. Filing bankruptcy can be an intimidating process, so allowing individuals to understand their qualification on the Chapter 7 bankruptcy means test, as well as an estimate for their Chapter 13 bankruptcy plan payment can help relieve some of the unknown. Not only does it answer any questions that someone may have but it also provides unbiased information to help someone make the most informed decision. A bankruptcy calculator is a web based app where individuals can input their information to see what their debt relief options may be. This then allows them to seek legal advice and guidance from a bankruptcy attorney, like those here, from a more informed standpoint.

How are the Results Presented to the Consumer?

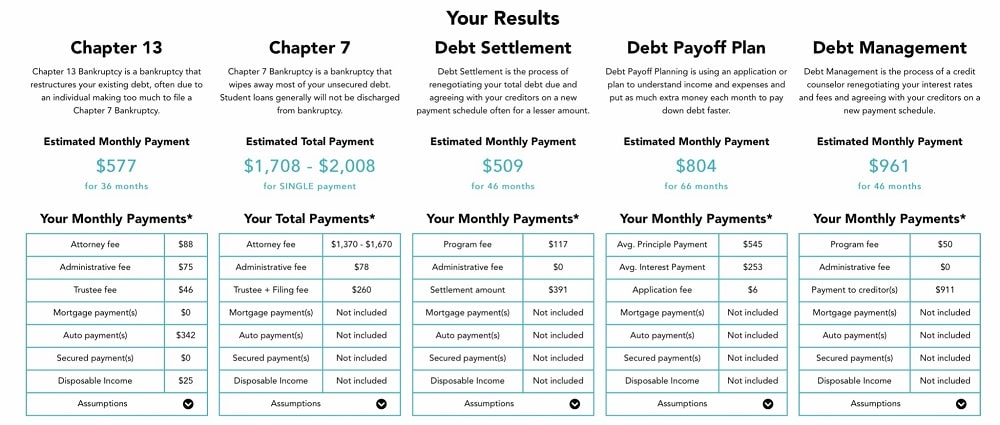

As we strive to provide all of our information in an unbiased manner, we provide all of the pros, cons, cost estimates, as well as timeline for each debt relief option. Some of the main factors to consider when making a debt relief decision are:

- Term length

- Total cost including any added fees

- Credit score impact

- Credit report impact

- Asset protection

Sometimes it may not be clear which option may be best, so allow folks to compare their options to help them make the most informed decision. It also shares advantages and disadvantages of bankruptcy and alternatives. It also shows how cheap bankruptcy may be in your area.

How we used Video Software to Uncover User Experience Issues

Fortunately, there are different types of user recording video softwares that help us analyze user behavior in ways we may have never been able to before. With that being said, we took advantage of this by using FullStory to closely take a look at different ways we could improve our next user’s experience.

How we Improved our User’s Experience

Since we want to provide the most helpful and useful bankruptcy calculator, we took a look at user drop off points, time spent, etc. Sometimes it can be hard to tell what the specific reason may be for a decrease in the number of users taking the calculator. Since we were able to analyze the user’s behavior, we were able to see where the majority of the users were dropping off and update our calculators to be more beneficial to the user.

Not only is drop off rate important to understand, but seeing the amount of time spent on each part of the calculator was extremely helpful to see if there was a part that didn’t make a lot of sense to the user. We are also humans, so we can sometimes draft questions that may not be the most eloquent way to ask something. Given that we may not always compose the perfect question, we can see where users are getting stuck and update questions to be more easily understandable.

How we use Phone and Email APIs to detect Bad Information

As you may assume, there are a lot of individuals that may not want to be contacted. We understand that and that is why we offered the four different contact options:

- None of the above – Results are provided and no phone call is made

- Analyst Review – A debt relief analyst gives you a call to go over your different options

- Provide to Attorney – Provide information to a local attorney for a free consultation

- All of the above – Either a bankruptcy attorney or analyst will give you a call to go over your options

We don’t want to call people unless they want to be called, however, there are sometimes individuals who may select one of the contact options and give us fake information. Fortunately, we implemented phone and email APIs that help detect a bad phone number or email address.

What Happens if Someone Enters Bad Information?

We completely understand that we all make mistakes and fall prone to typos every now and again. With that being said, since we ask for email and phone number for anyone that selects an option other than ‘none of the above’, we automatically send an email to the user when we detect a bad phone number.

How we use User Issues to Develop Better Questions

Piggy-backing off what we talked about earlier in the article regarding updating the calculator to provide a more helpful experience, we are actively developing better questions based on user issues we may come across.

One of the most important pieces of information to consider when thinking about bankruptcy is annual gross income. In order to qualify for Chapter 7 bankruptcy, you need to pass the Chapter 7 means test by falling below the median income guideline. The income limit for Chapter 7 is based on:

- Household Size

- Annual Gross Income

- State of Residence

The median household income guideline is calculated based on the individual’s household size and state they live in. For instance, someone living in California may have a higher income threshold than someone living in North Carolina.

Given the fact that annual gross income is so important when determining the best bankruptcy option, we found that there were a handful of user issues when we asked about their income. For instance, not everyone is paid on the same schedule. Some are paid biweekly, some are one a month, etc. Originally we only asked the user to enter how much they are paid each month but we found that the amount that was entered was often incorrect. Given this issue, we updated it to allow the user to choose their pay schedule from biweekly, monthly, etc. After making this slight change we found that there was a large increase in correct inputs.

Conclusion

Bankruptcy calculators are a great starting place for individuals that are looking to see what their debt relief options could look like. Given that everyone may be in different financial situations, it is important to continuously analyze and update the questions and results to create the most useful bankruptcy calculator. If you have any questions feel free to reach me directly at 833-272-3631.