Fraud and money laundering detection in real time

These activities can yield negative impact on the financial sector and disturb the stability of different states as well. To bring things under control, authorities need to implement strict fraud and money laundering detection systems so that such activities can be detected and stopped in real time.

What is money laundering all about?

Money laundering is a criminal act which includes online trading, fraud schemes, smuggling and illegal transfer of money. Although Financial Action Task Force (FATF) was established to control fraud and money laundering, but companies should definitely implement strict control parameters within their organization to avoid any type of fraud or scam.

The profit generated by such criminal activities is released by moving the funds to a second place illegally or is controlled without giving attention to the concerned authorities. By its nature, money laundering is an illegal activity and generally occurs outside of the normal range of financial and economic statistics. However, the process is meant to be dealt with caution for which it is important that you know the magnitude of money laundering. The process is divided into three parts known as Placement, Layering and Integration by which the laundering activity is performed illegally.

Detecting money laundering

There are different approaches through which anti-money laundering system works in real time to stop this fraudulent activity. Real time AML systems usually stops serial launderers who transfer money from one bank branch to another bank brank and move their funds step by step. As it is based on the concept of In-Memory Computing (IMC), the approach is used to simplify architecture and improve analytics on big data. Moreover, IMC is used to deliver optimal customer experience by its super-fast computing technology and real-time data scaling features.

Furthermore, anti-money laundering systems can be controlled and implemented to eliminate the risk of money laundering in real time as well. Differences between national AML systems are also a target of criminals who intent to move their networks through different regions and make their financial systems ineffective. Robust AML technologies adapt to changes made within the financial system in real time to fail money laundering techniques and end fraudulent activities with immediate effect.

How does the AML system work?

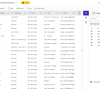

The anti-money laundering system is programmed to identify suspicious behavior and increase effectiveness over time. By focusing on regular priorities, the system is tested to its full functionality before being implemented within any financial institution. The risk-based approach is applied to identify the risks of money laundering and illegal financing for different market segments and transactions.

Leading banks and financial institutions have started to leverage real time analytics and machine learning to achieve better compliance, consumer metrics, fraud detection and risk management facilities. As Machine learning is the finest approach to identify the potential causes of fraud and money laundering, it can be used to compare millions of transactions within a fraction of a second.

The Real-Time AML Approach

There are a number of scenarios where the real time AML system is working and delivering positive outcomes as well. As it is used to stop serial launderers, real time AML also works with the regulators to overview de-risking activities. Risk-based approach is one of the major components of the AML systems and it is implemented by reviewing the scale, complexity and nature of a financial institution’s business.

Furthermore, other factors such as diversity of operations and distribution channels should also be overviewed when applying the risk-based approach for any bank or financial institution. However, with the improvement of technology solutions, real time AML cannot be considered as the optimal practice for all types of financial institutions.

Best real time Anti-Money laundering and fraud detection practices

The real-time AML system is supposed to be accurate, effective and reliable so that it does not stop transactions that are not criminal in any case. As doing so will damage the Fl and future business of several organizations, the system must be designed to be accurate in the analysis of transactions in every case. There are proven reasons both for and against using real time AML and fraud detection practices for which the industry needs to analyze the cost and benefits of using the system in advance.

Moreover, real time AML is certainly not practical for all industries as they should analyze and compare the costs, benefits and operation of the approach in advance. Key business advantages of real-time AML systems include reduced cost and enhanced fraud detection process which is return makes the financial institution safe and protected.

Business advantages

Real time Anti-Money laundering and fraud detection systems not only make the financial systems safe, but also ensure smooth business operations as well. Insurance and banking companies require streaming analytics and real time data integration to deliver better customer experience along increased profitability. Money laundering and fraud detection systems ensure regulatory compliance by monitoring global transactions in order to respond to customer queries immediately.

Being an end to end solution for real time data integration, real time AML systems offer data visualization, streamlining analytics and enable automated response as well. Furthermore, machine learning models are implemented to stop criminal acts such as misappropriation of funds, extortion or trafficking.

Conclusion

Financial institutions, banks and industries are greatly affected with money laundering and have to cope with huge losses as well. To ensure safe transactions, fraud detection and real time anti-money laundering systems are implemented within the organizations. These systems are highly scalable, deliver accurate services and stop fraudulent activities in real time.

AML units work as per the standard finance model which enables them to reduce risk, improve regulatory relations and cut costs as well. Furthermore, anti-money laundering systems work in real time and save financial institutions from any kind of unwanted loss.